Unlocking the U.S. Economic Puzzle

Unlocking the U.S. Economic Puzzle: 📈

Strong Labor Market, Housing Squeeze, Soaring Mortgage Rates, and the Millennial Housing Gap. Swipe left to dive into the key factors shaping the current U.S. economic landscape.

The Economics:

The latest data from the Bureau of Economic Analysis (BEA) reveals:

- The U.S. economy is continuing its expansion, with a 2.1% growth in real Gross Domestic Product (GDP) for the second quarter of 2023.

- Personal consumption expenditures saw a decline from 3.8% in the first quarter to 0.8% in the second, but this was offset by a notable increase in investment expenditures from -9.0% to 5.2%.

- The overall GDP growth surpasses the Congressional Budget Office's estimate for 2023.

- The labor market remains robust, with the addition of 336,000 jobs in September 2023, exceeding the 12-month average.

- Job growth was prominent in leisure and hospitality, government, health care, professional, scientific, and technical services, as well as social assistance.

- Positive revisions to non-farm payroll growth for July and August indicate the resilience of the labor market.

- Despite a stable unemployment rate of 3.8% and unchanged labor force participation and employment-population ratios, the number of job openings reached a high of 690,000 in August, maintaining a high ratio of job openings to unemployed individuals.

- In terms of inflation, there are signs of relief, as the August reading came in below expectations. While overall inflation has decreased, rising energy prices pose potential risks. Core inflation, excluding food and energy, experienced a slight increase, but the year-over-year core PCE price inflation was 3.9%, the lowest since mid-2021. Prices for goods and services both increased, with goods inflation at 0.8% and services at 0.2%. The Federal Reserve's closely tracked "super core" inflation measure, excluding energy and housing, remained steady in August and rose 4.2% year-over-year.

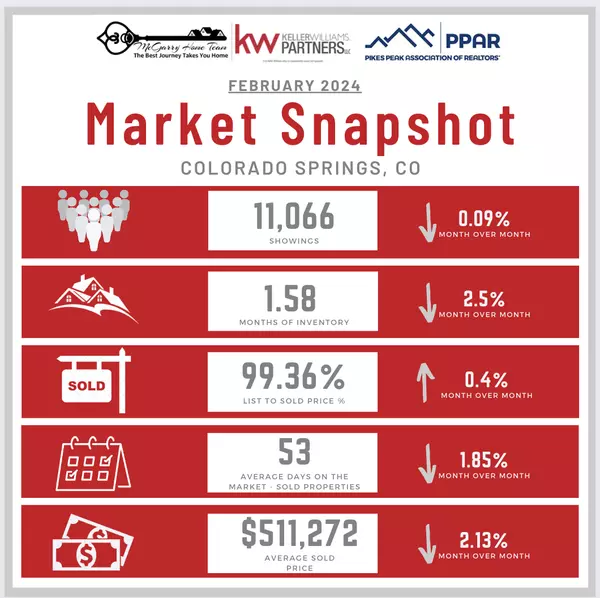

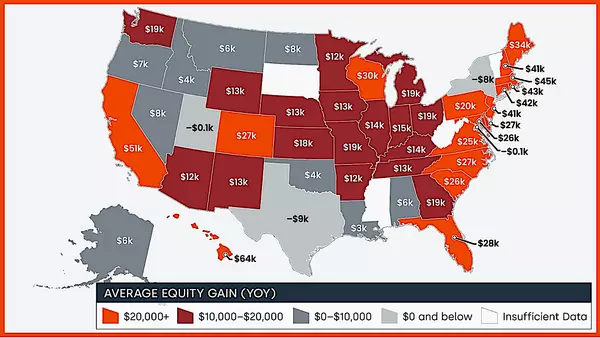

The U.S. Housing Market:

- High-interest rates, exceeding 7% since August, are impacting the housing market.

- Homebuyers are delaying purchases due to elevated rates.

- Existing home sales dropped 15.3% from August 2022, but median sale prices rose by 3.9%.

- Limited inventory is driving buyers toward new homes, with sales up 5.8% from last year.

- Total home sales, combining new and existing homes, fell 12.8% from the previous August.

- The Housing Market Index dropped across all components, reflecting weaker demand and seller confidence.

- Incentives and price reductions are increasingly used to boost sales.

- NAR's Pending Home Sales Index is down 18.7% year over year.

- Despite decreasing demand and supply measures, the tight supply is pushing house prices up, with a 4.6% increase in July according to the FHFA Purchase Only House Price Index.

The U.S. Mortgage Market:

- Interest rates on 10-year Treasuries reached a 16-year high at 4.8% on October 17, 2023.

- This increase also led to 30-year fixed-rate mortgages hitting a 23-year high, reaching 7.49% in early October.

- Higher rates have caused a significant decline in mortgage demand, with a 25% decrease in total mortgage applications and a 27% drop in the purchase index in the third week of September. Compared to pre-pandemic levels, purchase originations were down 41%, and refinancing was down 58%.

- Though mortgage delinquencies have been generally low, there was a slight increase in August 2023.

- Loans 30 or more days past due rose from 2% in July to 2.04%, while loans 60 or more days past due increased from 0.91% to 0.94%.

- Serious delinquencies rose to 0.59% in August 2023 from 0.58% in July 2023 and 0.55% in August 2022.

What's Next?

- Economic conditions have been strong, but rising interest rates and geopolitical uncertainties are impacting consumer confidence and spending.

- The outlook suggests a slowing economy, with growth expected to decelerate by the end of the year and remain modest in 2024.

- Inflation is anticipated to ease gradually, keeping mortgage rates elevated.

- This has implications for the housing market, as higher rates are likely to dampen both demand and supply, keeping sales volume low.

- Mortgage origination volume is expected to stay subdued, with the refinance market significantly impacted by rising rates.

- Overall, total mortgage originations are projected to remain flat for the rest of the year, with modest growth in 2024.

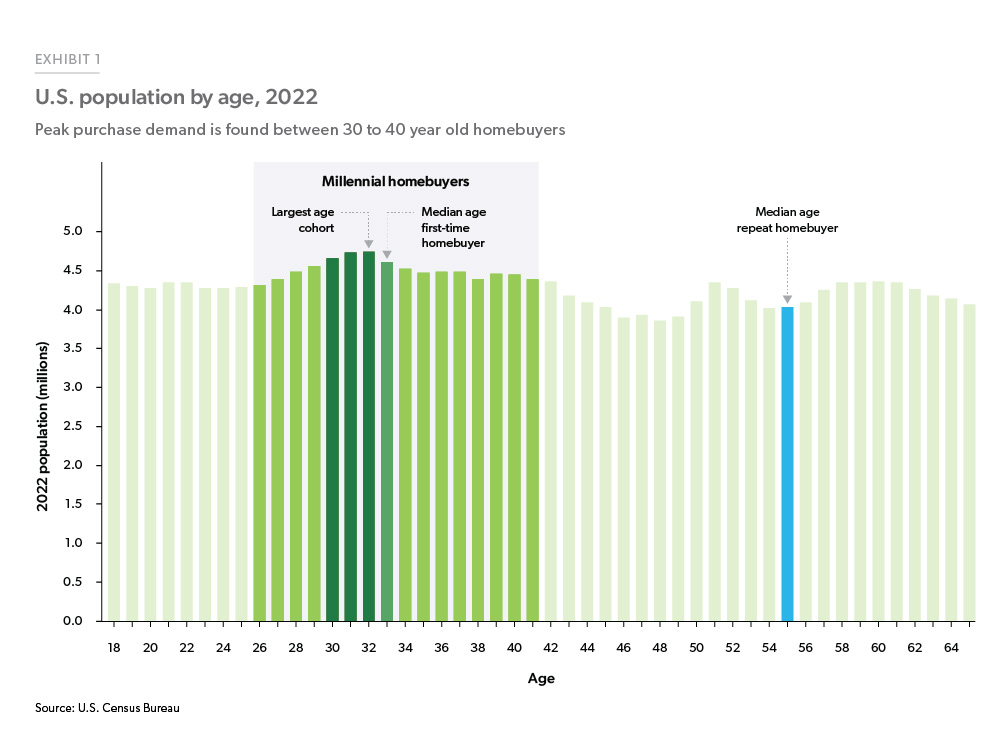

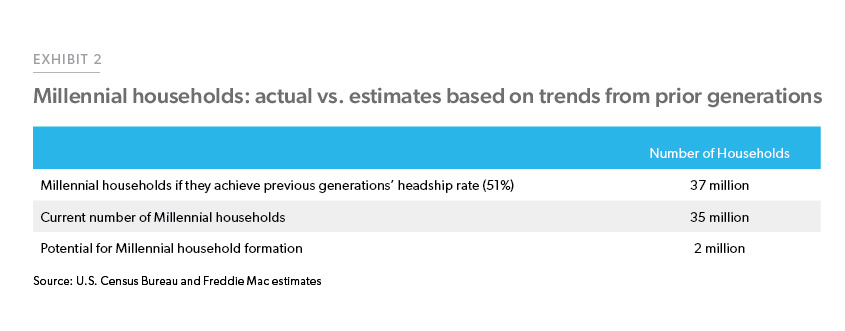

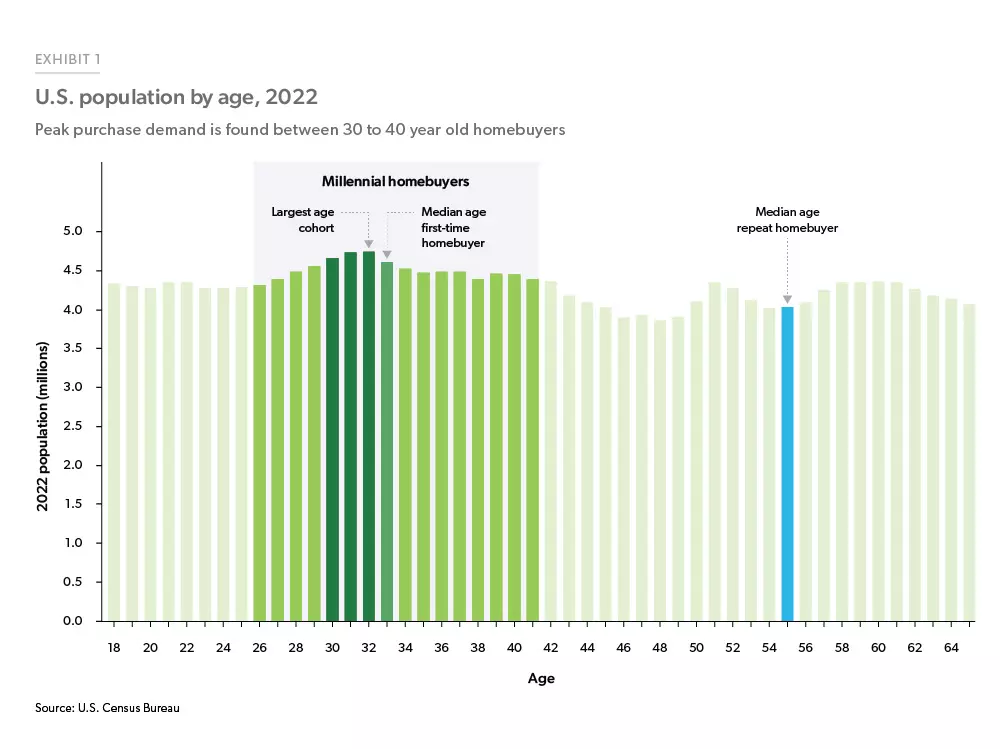

Millennials in the Market:

Millennials, the largest generation in history, have faced challenges like high housing costs and delayed marriage therefore forming independent households. Despite these obstacles, Millennial household formations have increased, driven by factors such as the need for more space during the pandemic and low interest rates. If Millennials formed households at the same rate as previous generations, there could be an additional 2 million households in the U.S. The analysis indicates potential for new households and increased homeownership rates among younger adults, leading to future housing demand. Freddie Mac, a financial institution, offers customized loan products to help Millennials overcome housing challenges, and in the second quarter of 2023, they assisted a significant number of families in buying, refinancing, or renting homes, including a historic high of first-time homebuyers.

#EconomicTrends #HousingMarket #Millennials

Read more at www.freddiemac.com/research

Click here for affordable solutions

Interested in Selling? | Interested in Buying? | Information on Investing

Categories

Recent Posts

"My job is to find and attract mastery-based agents to the office, protect the culture, and make sure everyone is happy! "