Unlocking Wealth: Homeowner Equity Insights from Q3 2023

Unlocking Wealth: Homeowner Equity Insights from Q3 2023

For millions of Americans, homeownership is not just a place to live but also a significant source of wealth. In the third quarter of 2023, a new analysis from real estate data firm CoreLogic reveals promising news for homeowners across the nation – their home equity has seen a substantial increase, adding to their overall wealth accumulation.

National Overview:

The typical American homeowner experienced a remarkable rise in home equity, with an average increase of $20,000 or 6.8% compared to the previous year. This home equity growth is attributed to the surge in home prices, defying challenges such as the highest mortgage rates in two decades.

Housing Market Dynamics:

Despite facing headwinds in the form of soaring mortgage rates, the housing market has witnessed an impressive 9% increase in average home prices throughout the year, according to the National Association of Realtors. This surge in home values has directly contributed to the overall growth in homeowners' equity, a crucial factor in wealth accumulation.

Key to Building Wealth:

Home equity is highlighted as a pivotal element in building wealth for property owners. It serves as a valuable resource, offering options such as accessing funds through a home-equity line of credit. Additionally, when homeowners decide to sell their properties, the increased equity ensures a higher return after settling their mortgage obligations.

Insights from Chief Economist:

Selma Hepp, the chief economist at CoreLogic, emphasizes the direct correlation between home equity growth and rising home prices. Despite the challenges prevalent in the housing market, the robust growth in 2023 has significantly contributed to the positive trajectory of homeowners' wealth accumulation.

"Home equity growth is driven by home price growth, and so we have had a lot of growth this year, considering everything else that is going on in the housing market," Selma Hepp, chief economist at CoreLogic, told CBS MoneyWatch.

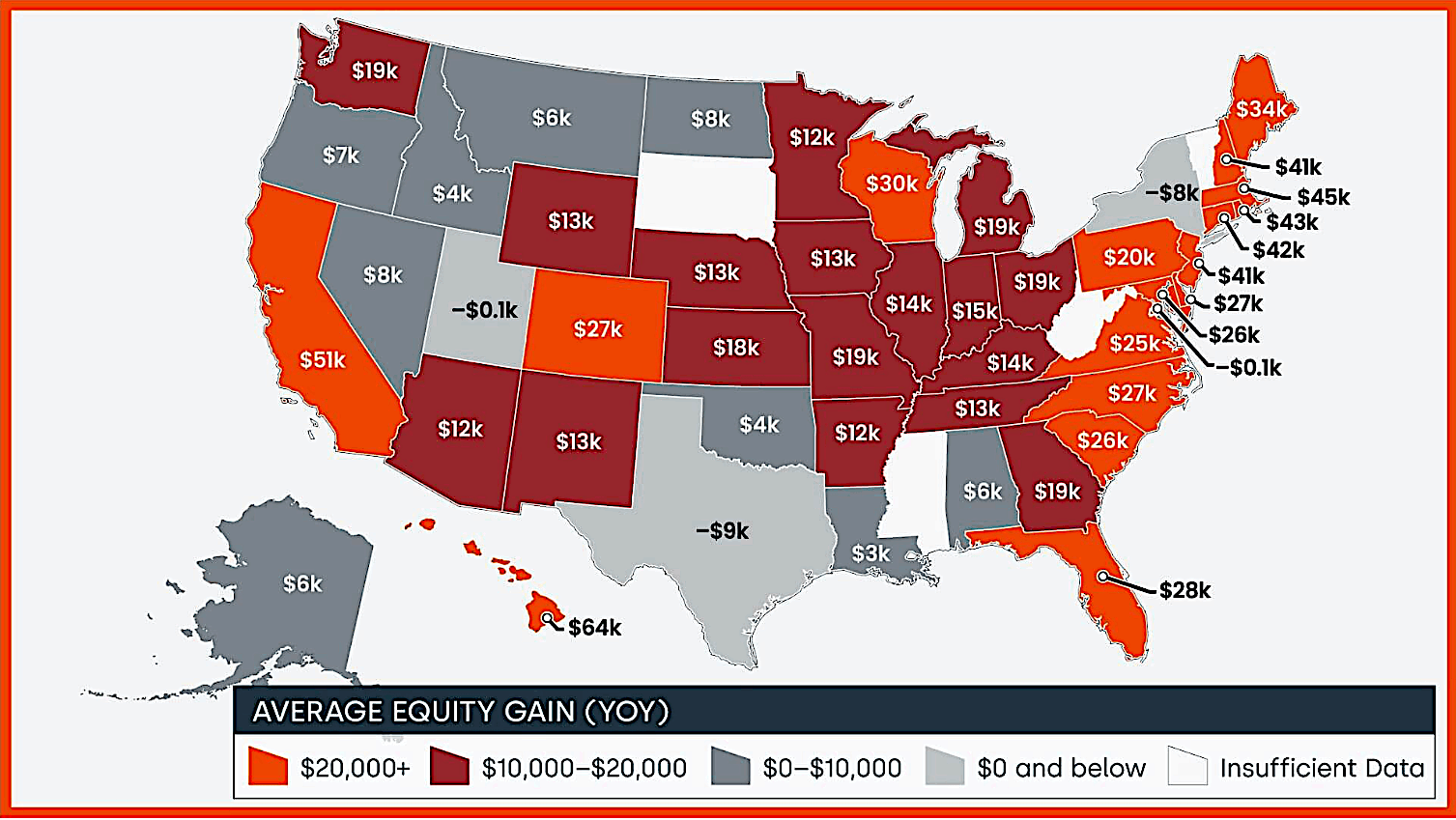

Regional Spotlight - Colorado:

The article places a spotlight on Colorado, revealing that the average equity return for homeowners in the state was an impressive $27,000. This showcases the positive impact of the overall growth in home values on homeowners in Colorado, contributing substantially to their wealth accumulation.

Regional Comparisons:

Drawing attention to regional disparities, the article compares equity returns across states. California emerges as the highest, with homeowners experiencing an average home equity growth of $51,000. In contrast, Texas faces a unique scenario with homeowners showing a negative equity return of -$9,000, underlining the diverse dynamics of the housing market.

The Homeowner Equity Insights from Q3 2023 reflect a positive trend in the housing market dynamics, with homeowners benefiting from the substantial growth in home values. The article encourages potential buyers and sellers to explore the wealth-building potential of homeownership amidst evolving market dynamics.

Interested in Selling? | Interested in Buying? | Information on Investing

Information sources and articles:

CoreLogic

Full Article and Interactive U.S. Equity Map

Selma Hepp, Chief Economist

CBS News

CBS News MoneyWatch

National Association of Realtors

Categories

Recent Posts

"My job is to find and attract mastery-based agents to the office, protect the culture, and make sure everyone is happy! "