The Impact of Interest Rates on the Real Estate Market

Interest rates have a significant impact on the real estate market, affecting both homebuyers and sellers. Changes in interest rates can affect the affordability of homes, influence the demand for housing, and impact the overall health of the real estate market. A general 'rule of thumb' is for every 1% in interest rate change, buying power changes by 10%. For example: someone is approved for $400,000 with a 6% interest rate. If the rate goes up to 7%, now they are approved for a $360,000 purchase. If the rate goes down to 5%, they can purchase up to $440,000.

-

Affordability: The cost of borrowing money to purchase a home is directly influenced by interest rates. When interest rates are low, homebuyers can afford larger loans, making homes more affordable. Conversely, when interest rates are high, the cost of borrowing money increases, making homes less affordable.

-

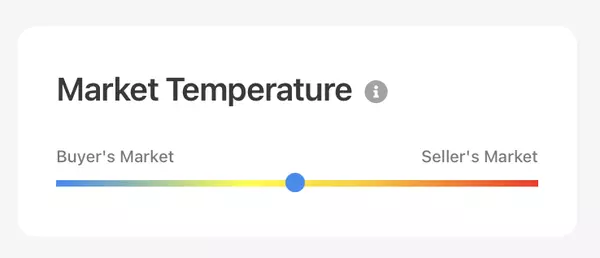

Demand for Housing: Interest rates can also impact the demand for housing. When interest rates are low, more people are likely to take out mortgages, leading to an increase in demand for housing. This can result in higher home prices and a more competitive housing market. On the other hand, when interest rates are high, fewer people are likely to take out mortgages, leading to a decrease in demand for housing.

-

Refinancing: Changes in interest rates can also impact homeowners who are looking to refinance their mortgages. When interest rates are low, homeowners can refinance their mortgages to lower their monthly payments, providing them with more disposable income. Conversely, when interest rates are high, refinancing becomes less attractive, and homeowners may be less likely to pursue it.

-

Economic Growth: The health of the real estate market is closely tied to the overall health of the economy. Changes in interest rates can impact economic growth, which, in turn, can impact the real estate market. For example, when interest rates are low, businesses may have more access to capital, which can lead to job growth and increased demand for housing.

-

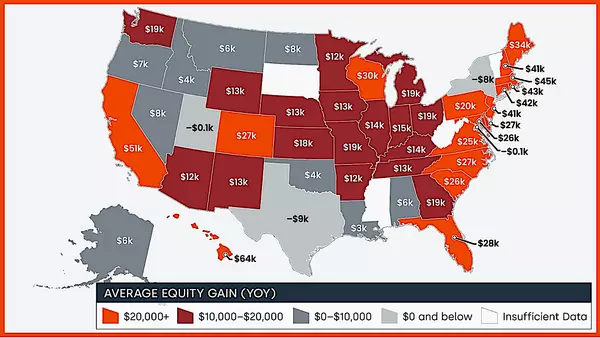

Investment Activity: Interest rates can also impact real estate investment activity. When interest rates are low, investors may be more likely to invest in real estate, as the cost of borrowing money is lower. Conversely, when interest rates are high, real estate investment becomes less attractive, and investors may be less likely to pursue it.

In summary, interest rates have a significant impact on the real estate market. Changes in interest rates can affect the affordability of homes, influence the demand for housing, impact refinancing activity, impact economic growth, and influence real estate investment activity. As a result, both homebuyers and sellers need to be aware of how interest rates can impact the real estate market and adjust their strategies accordingly.

Categories

Recent Posts

"My job is to find and attract mastery-based agents to the office, protect the culture, and make sure everyone is happy! "