Rent vs Buy

When it comes to deciding between renting or buying a home, there are several factors to consider. While renting may seem like the easier option, there are many benefits to owning a home that may make it the better choice for you.

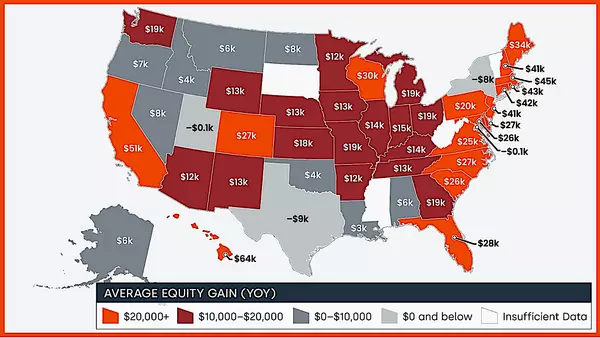

One of the main advantages of buying a home is that it is an investment. When you purchase a home, you are making a long-term investment that usually will increase in value over time. This means that you can build equity in your home, which can be used as a source of wealth in the future.

Another benefit to owning a home is that it offers more stability than renting. When you rent a home, you are subject to the landlord's rules and regulations, and you may be forced to move if the landlord decides to sell the property or raise the rent. When you own a home, you have more control over your living situation and can make changes to your home as you see fit.

While buying a home may seem like a daunting task, there are many resources available to help you navigate the process. One of the most important steps in buying a home is securing a mortgage. A mortgage is a loan that you can use to purchase a home, and it is typically paid back over a period of 15 to 30 years.

While interest rates on mortgages can vary, even when they are higher, owning a home can still be a better financial decision in the long run. This is because the monthly payments you make towards your mortgage go towards building equity in your home, rather than paying someone else's mortgage through rent payments.

In conclusion, while renting may seem like the easier option, buying a home offers many benefits that make it a better financial decision in the long run. Whether you are a first-time homebuyer or an experienced homeowner, there are many resources available to help you find the perfect home and secure a mortgage that works for you.

Categories

Recent Posts

"My job is to find and attract mastery-based agents to the office, protect the culture, and make sure everyone is happy! "